1031 Exchange Trends and Info for 2021 With Guest Writer Kyle Williams IPX1031

Please welcome our guest writer, Kyle Williams with 1031 IPX Exchange.

January 2021

Nicole Serviss, RE/MAX Elite

Kyle Williams, IPX1031

First of all, what is a 1031 Exchange?

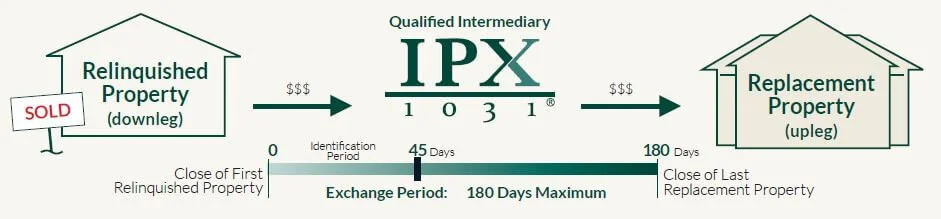

Like Kind Exchanges, also known as tax deferred exchanges, are defined by Internal Revenue Code (IRC) section 1031. A 1031 Tax Deferred Exchange offers taxpayers one of the last great opportunities to build wealth and save taxes. By completing a 1031 Exchange, the Taxpayer (“Exchanger”) can dispose of investment or business-use assets, acquire replacement property and defer the tax that would ordinarily be due upon the sale.

2020 was yet again another record year for 1031 Exchanges.

What’s in store for 2021?

Commercial real estate is predicted to have a mixed forecast in 2021 with certain sectors, such as industrial, experiencing robust growth while others continue to struggle. With low interest rates expected to continue and the economy recovering, many CRE sectors should normalize by mid to late 2021 if the vaccines are widely available.

Another strong year for 1031 Tax Deferred Exchange transactional activity is anticipated in 2021. Two factors will drive significant transactional activity. First, borrowing rates remain historically low. Second, the pandemic has created an unprecedented need to repurpose and renovate commercial real estate to meet post-pandemic business models.

Particularly impacted are office, retail and hotel properties, given the successes of widespread working from home and use of virtual meeting technology. Even multi-family and single family rental properties now need space for use as a home office.

Section 1031 Like-Kind Exchanges provide incentive for owners who are not in a position to make significant building modifications to transfer properties into the hands of buyers willing and able to invest fresh capital and take these properties to their highest and best use for future tenant needs.

Given the dueling pandemic and economic crises, major tax reform does not appear to be a current priority of the new Administration. Nevertheless, the need to pay for pandemic relief and new legislative initiatives could make Section 1031 a target for tax revenue seekers. Our efforts to educate our policy makers to the legitimate, economically important benefits of Section 1031 continue.

1031 trends we are anticipating:

Continued 1031 growth in industrial, self-storage, R&D, medical/office, and multi-family sectors.

Individual exchangers will continue to sell investment property and purchase Replacement Property in warmer climates or other locations with high vacation rental income.

Continued increase of Replacement Property purchases of qualifying vacation home rental properties.

An uptick in Build-to-Suit Exchanges where clients make improvements to their Replacement Properties.

Reverse Exchange momentum will continue to grow with a shortage of Replacement Property inventory and a competitive buyers market.

Retirement/Estate planning with Exchanged property will drive much investor 1031 transactional activity.

Especially while the interest rates on financing are low and favorable, more taxpayers maximizing their 1031 tax deferral potential to grow their portfolios by selling while prices stay high, preserving their equity by using all proceeds to exchange into the purchase of larger or multiple Replacement Properties.

With expected recovery and overall growth in investment and commercial real estate transactions, we are forecasting another strong year for 1031 Tax Deferred Exchange transactional activity.

A 1031 Exchange transaction requires planning, expertise and support.

Here’s a checklist outlining key steps in your exchange.

Choose your 1031 Qualified Intermediary (QI)

Consult with your tax professionals

Include Cooperation Clause language in your purchase and sale agreement

QI prepares your exchange documents

Start searching for Replacement Property

Sign all documents QI prepares

Sell your Relinquished Property

Identify your Replacement Property

Enter into contract on Replacement Property

Contact QI once Replacement Property escrow is opened

Close on Replacement Property

QI transfers funds to complete your purchase

Your exchange is complete

Thank you Kyle and IPX1031 for sharing this great information! His contact info is below. Please reach out to him if you have plans to sell your investment property (land, multi-family, rental house, commercial space) and tell him Nicole Serviss sent you!

Kyle Williams, Vice President and Account Executive with Investment Property Exchange Services, Inc.

responsible for IPX1031 sales covering Washington state. With over 15 years of financial brokerage and real estate experience, including REITs, 1031 Tax Deferred Exchanges, 1031 Exchange rules and regulations, and other real estate investments, he enjoys speaking with brokers, CPAs, attorneys, investors, and real estate professionals. Kyle received his B.A. from The Central Washington University in Political Science and History.

Nicole Serviss, Broker and REALTOR with RE/MAX Elite

Let me know if I can help give you an estimated value of your investment property.

If you’re getting ready to sell your Snohomish County home, you’ll probably interview a few Realtors. But there’s one question that matters more than all the others.