How Much Does it Cost to Sell a House in Washington State?

Selling your home in Washington State—especially in Snohomish County—can be an exciting step forward, but it's important to understand the costs involved so you can plan ahead and avoid surprises. From agent commissions to taxes and prep work, the expenses can add up quickly. In this guide, we'll walk you through the typical costs of selling a home in Washington, with a focus on what homeowners in Snohomish County should expect.

Real Estate Agent Commission(s)

In Washington, the real estate agent commission is typically the biggest cost when selling a home. There is no standard commission, but most of the time you see a charge based as a percentage of the sold price. You have the fee for the listing agent and an optional fee for the buyer’s agent.

While this is a significant expense, working with a skilled local agent can help you price your home competitively, attract qualified buyers, and negotiate favorable terms, ultimately maximizing your net proceeds.

You may choose to go the For Sale By Owner (FSBO) route, but be aware, FSBO properties nationwide tend to sell for 37% less. In the context of a $800k home, that’s potentially a $300k difference. Even if you're more skilled than the average FSBO seller, cutting that discrepancy down significantly, you could still earn $74k less than if you partnered with a realtor. And remember, with an average of 8.5% of the sales price equating to $68,000 in closing costs, you might be saving on commissions but still losing out financially.

What About Buyer’s Agent Compensation?

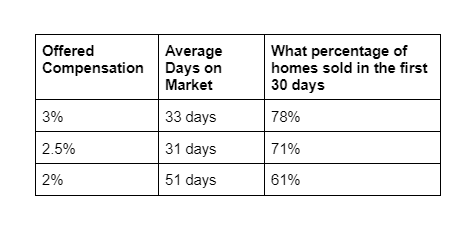

Compensating the buyer's agent is at your discretion. However, based on recent NWMLS data for Snohomish County resale homes, I would encourage a seller to offer compensation.

*Data sourced from the NWMLS

Excise Tax: A Seller’s Obligation

Washington State imposes a real estate excise tax (REET) on property sales. The rate is graduated based on the sale price, and local jurisdictions may add their own tax. In Snohomish County, the total REET can be up to 1.78% of the sale price.

For a $600,000 home, that’s approximately $10,680 in excise tax.

Calculated on a graduated system as follows:

- Up to $525,000: 1.10%

- $525,000.01 to $1,525,000: 1.28%

- $1,525,000.01 to $3,025,000: 2.75%

- Above $3,025,000: 3%

Closing Costs: Fees You Might Overlook

Beyond commissions and taxes, sellers often encounter additional closing costs, which can include:

Title and escrow fees: Shared between buyer and seller, these cover the transfer of ownership and legal documentation.

Recording fees: Charged by the county to officially record the sale.

Outstanding liens or judgments: Any debts tied to the property must be settled before or at closing.

These costs can vary but often total 1% to 3% of the sale price. For a $600,000 home, expect to pay between $6,000 and $18,000 in closing costs.

Home Preparation: Investing in First Impressions

Preparing your home for sale can enhance its appeal and potentially increase its value. Common expenses include:

Repairs and maintenance: Fixing leaky faucets, squeaky doors, or other minor issues.

Cleaning and decluttering: Professional cleaning services can make your home shine.

Staging: Arranging furniture and decor to showcase the home’s potential.

Landscaping: Improving curb appeal with trimmed lawns and fresh plants.

Depending on the extent of the work, these preparations can cost anywhere from $1,000 to $5,000 or more.

Optional Costs: Enhancing Marketability

Some sellers choose to invest in additional services to attract buyers:

Pre-inspection reports: Identifying issues before listing can build buyer confidence.

Home warranties: Offering a warranty can make your home more appealing.

These optional costs can range from a few hundred to a couple of thousand dollars, depending on the services selected.

Other Potential Extra Costs:

- Seller credits to the buyer

- HOA transfer fees, commonly $300

- Outstanding liens, like child support or construction-related

- Special assessments, if applicable

- Staging costs (Not if you hire The Serviss Group. That’s included in our fee)

Estimating Your Total Selling Costs

Here's a breakdown of potential costs for a $600,000 home:

Agent commissions: $40,000

Excise tax (1.78%): $10,680

Closing costs (2%): $12,000

Home preparation: $3,000

Optional services: $1,500

Total estimated costs: $67,180

This would leave you with approximately $532,820 before paying off any existing mortgage or other obligations.

Simple rule of thumb is to take the price you think your house will sell for and multiply that by .0815 to get your estimated closing costs.

Frequently Asked Questions

Q: Can I negotiate the agent commission?

A: Yes, commissions are negotiable. Discuss options with your agent to find a structure that works for both parties.

Q: Are there any tax exemptions for sellers?

A: If you’ve lived in your home for at least two of the past five years, you may qualify for a capital gains tax exemption on the federal level. Washington State does not have a capital gains tax on real estate sales.

Q: Should I invest in staging my home?

A: Staging can help buyers visualize the space and may lead to a quicker sale at a higher price.

Q: What if I can’t afford upfront costs for repairs or staging?

A: Some agents offer programs to cover these costs upfront, to be reimbursed at closing. Discuss this option with your agent.

Q: How can I estimate my net proceeds from the sale?

A: Use a home sale net proceeds calculator or consult with your agent to get a detailed estimate based on your specific situation.

Ready to Sell Your Home?

Understanding the costs involved in selling your home is crucial for a successful transaction. If you're considering selling your home, The Serviss Group is here to guide you through every step of the process. Contact us today to schedule a consultation and learn how we can help you achieve your real estate goals.

If you need help finding a realtor in your area, please reach out and I’d be happy to connect you with one who can help.