LEARN MORE ABOUT THE LOCAL MARKET.

How Much Does it Cost to Sell a House in Washington State?

Are you contemplating selling your home in the Evergreen State but feeling uncertain about the financial implications? Navigating the true costs of selling your house in Washington can be more complex than you think. Let's demystify the process and delve into both the known and the often-unanticipated expenses that come with selling a property.

Selling your home in Washington State—especially in Snohomish County—can be an exciting step forward, but it's important to understand the costs involved so you can plan ahead and avoid surprises. From agent commissions to taxes and prep work, the expenses can add up quickly. In this guide, we'll walk you through the typical costs of selling a home in Washington, with a focus on what homeowners in Snohomish County should expect.

Real Estate Agent Commission(s)

In Washington, the real estate agent commission is typically the biggest cost when selling a home. There is no standard commission, but most of the time you see a charge based as a percentage of the sold price. You have the fee for the listing agent and an optional fee for the buyer’s agent.

While this is a significant expense, working with a skilled local agent can help you price your home competitively, attract qualified buyers, and negotiate favorable terms, ultimately maximizing your net proceeds.

You may choose to go the For Sale By Owner (FSBO) route, but be aware, FSBO properties nationwide tend to sell for 37% less. In the context of a $800k home, that’s potentially a $300k difference. Even if you're more skilled than the average FSBO seller, cutting that discrepancy down significantly, you could still earn $74k less than if you partnered with a realtor. And remember, with an average of 8.5% of the sales price equating to $68,000 in closing costs, you might be saving on commissions but still losing out financially.

What About Buyer’s Agent Compensation?

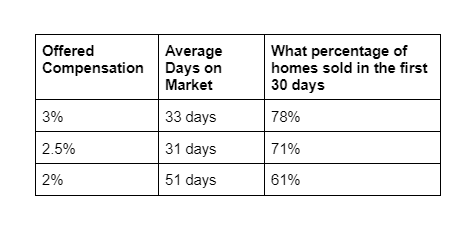

Compensating the buyer's agent is at your discretion. However, based on recent NWMLS data for Snohomish County resale homes, I would encourage a seller to offer compensation.

*Data sourced from the NWMLS

Excise Tax: A Seller’s Obligation

Washington State imposes a real estate excise tax (REET) on property sales. The rate is graduated based on the sale price, and local jurisdictions may add their own tax. In Snohomish County, the total REET can be up to 1.78% of the sale price.

For a $600,000 home, that’s approximately $10,680 in excise tax.

Calculated on a graduated system as follows:

- Up to $525,000: 1.10%

- $525,000.01 to $1,525,000: 1.28%

- $1,525,000.01 to $3,025,000: 2.75%

- Above $3,025,000: 3%

Closing Costs: Fees You Might Overlook

Beyond commissions and taxes, sellers often encounter additional closing costs, which can include:

Title and escrow fees: Shared between buyer and seller, these cover the transfer of ownership and legal documentation.

Recording fees: Charged by the county to officially record the sale.

Outstanding liens or judgments: Any debts tied to the property must be settled before or at closing.

These costs can vary but often total 1% to 3% of the sale price. For a $600,000 home, expect to pay between $6,000 and $18,000 in closing costs.

Home Preparation: Investing in First Impressions

Preparing your home for sale can enhance its appeal and potentially increase its value. Common expenses include:

Repairs and maintenance: Fixing leaky faucets, squeaky doors, or other minor issues.

Cleaning and decluttering: Professional cleaning services can make your home shine.

Staging: Arranging furniture and decor to showcase the home’s potential.

Landscaping: Improving curb appeal with trimmed lawns and fresh plants.

Depending on the extent of the work, these preparations can cost anywhere from $1,000 to $5,000 or more.

Optional Costs: Enhancing Marketability

Some sellers choose to invest in additional services to attract buyers:

Pre-inspection reports: Identifying issues before listing can build buyer confidence.

Home warranties: Offering a warranty can make your home more appealing.

These optional costs can range from a few hundred to a couple of thousand dollars, depending on the services selected.

Other Potential Extra Costs:

- Seller credits to the buyer

- HOA transfer fees, commonly $300

- Outstanding liens, like child support or construction-related

- Special assessments, if applicable

- Staging costs (Not if you hire The Serviss Group. That’s included in our fee)

Estimating Your Total Selling Costs

Here's a breakdown of potential costs for a $600,000 home:

Agent commissions: $40,000

Excise tax (1.78%): $10,680

Closing costs (2%): $12,000

Home preparation: $3,000

Optional services: $1,500

Total estimated costs: $67,180

This would leave you with approximately $532,820 before paying off any existing mortgage or other obligations.

Simple rule of thumb is to take the price you think your house will sell for and multiply that by .0815 to get your estimated closing costs.

Frequently Asked Questions

Q: Can I negotiate the agent commission?

A: Yes, commissions are negotiable. Discuss options with your agent to find a structure that works for both parties.

Q: Are there any tax exemptions for sellers?

A: If you’ve lived in your home for at least two of the past five years, you may qualify for a capital gains tax exemption on the federal level. Washington State does not have a capital gains tax on real estate sales.

Q: Should I invest in staging my home?

A: Staging can help buyers visualize the space and may lead to a quicker sale at a higher price.

Q: What if I can’t afford upfront costs for repairs or staging?

A: Some agents offer programs to cover these costs upfront, to be reimbursed at closing. Discuss this option with your agent.

Q: How can I estimate my net proceeds from the sale?

A: Use a home sale net proceeds calculator or consult with your agent to get a detailed estimate based on your specific situation.

Ready to Sell Your Home?

Understanding the costs involved in selling your home is crucial for a successful transaction. If you're considering selling your home, The Serviss Group is here to guide you through every step of the process. Contact us today to schedule a consultation and learn how we can help you achieve your real estate goals.

If you need help finding a realtor in your area, please reach out and I’d be happy to connect you with one who can help.

Need a REALTOR?

Interview The Serviss Group

The Impact of Buyer Broker Compensation on Snohomish County Real Estate Sales

Understanding the nuances of buyer broker compensation can be a game-changer in how quickly you sell your home. In Snohomish County, as in many real estate markets, the percentage of commission offered to the buyer's broker can influence the sale process significantly.

The Impact of Buyer Broker Compensation on Snohomish County Real Estate Sales

Introduction Understanding the nuances of buyer broker compensation can be a game-changer in how quickly you sell your home. In Snohomish County, as in many real estate markets, the percentage of commission offered to the buyer's broker can influence the sale process significantly.

Understanding Buyer Broker Compensation In the world of Snohomish County real estate, buyer broker compensation refers to the percentage of the home's sale price that sellers offers to pay the buyer's broker. This is an important aspect of the listing agreement and one that can affect how appealing your property is to buyers' agents. While in WA state it is not a requirement for a seller to offer any compensation for the buyer's broker, I found this data sourced from the NWMLS for resale homes in Snohomish County very interesting!

The Data on Compensation and Sales Success Recent data sheds light on a fascinating trend within the Snohomish County real estate landscape: homes offering higher compensation to buyer brokers tend to sell faster and more frequently within the first 30 days on the market. Here’s what we’ve found:

3% Compensation: Homes in Snohomish County offering this compensation level to the buyer's broker are usually on the market for an average of 33 days, and a significant 78% of these homes are sold within the first month.

2.5% Compensation: These homes have a slightly lower average time on the market at 31 days, and about 71% sell within the first 30 days.

2% Compensation: Homes with this rate stay on the market longer, averaging 51 days, and only 61% sell within the initial month.

Best Practices for Sellers As a seller in the competitive Snohomish County real estate market, setting your compensation for the buyer's broker is a decision that should be made with careful consideration of the current market conditions, your timeline for selling, and the unique attributes of your property.

While the Snohomish County real estate market is influenced by numerous factors, compensation to buyer brokers is a lever that sellers can control. The recent data suggests that homes with higher offered compensation sell quicker and more often within the first 30 days. However, this is just one piece of the real estate puzzle. Partnering with a knowledgeable agent who understands the intricacies of Snohomish County real estate can provide you with tailored advice for your situation.

*In WA state it is not a requirement for a seller to offer any compensation for the buyer's broker. This data was sourced from the NWMLS on February 24th, 2024 and covers resale homes in Snohomish County that sold in the last 180 days.

Need a REALTOR?

Interview The Serviss Group

Avoid These Homebuyer Mistakes!

Buying a home, especially in the Snohomish and Seattle areas can be filled with challenges. If you're setting foot into the housing world for the first time, this guide is tailored to help you sidestep common pitfalls that often trip up new buyers.

Avoid These Homebuyer Mistakes!

Buying a home, especially in the Snohomish and Seattle areas can be filled with challenges.

If you're setting foot into the housing world for the first time, this guide is tailored to help you sidestep common pitfalls that often trip up new buyers.

Assessing Your Financial Health:

Before you dive into property listings or fall in love with a Seattle skyline view, it's crucial to assess your financial well-being. Understanding not just your savings but also your credit score and monthly expenses is vital.

The Impact of Credit Scores:

Your credit score is more than a number; it’s a gateway to better mortgage terms. A higher credit score could save you thousands. First-time homebuyers often overlook this, missing the chance to improve their scores before stepping into the mortgage arena.

The True Cost of Homeownership:

Snohomish real estate isn’t just about the purchase price. It's about the total cost of ownership, which includes property taxes, homeowners insurance, HOA dues, and maintenance. Make sure you factor in all your monthly costs when budgeting for your new home.

Location, Location, Location:

When it comes to Snohomish real estate and Seattle housing, location is paramount. Compromising on location for more square footage can be tempting, but the truth is, you can change your home but not its spot on the map. Factors like commute times, school quality, and neighborhood safety are crucial. I would discourage you to compromise on this one.

The Non-Negotiable Home Inspection:

In the heat of a bidding war, waiving a home inspection might seem appealing. Home inspections can uncover hidden issues that could cost you dearly in the long run. This small investment can save you from future financial headaches. There’s never going to be a perfect house. Even new construction has it’s flaws. A home inspection will help uncover any repairs needed so that you can either decide to walk away, ask the seller to fix it, OR accept the costs to repair it after you purchase the home.

Mortgage Shopping: Don’t Settle on Your First Offer

Mortgages come with varied rates and terms. Accepting the first offer might seem convenient, but shopping around could lead to significant savings. Make lenders compete for your business to get the best deal possible. Ask your bank, credit unions, and local small lenders to give you a quote.

The Home Buying Timeline:

Prepare for the long haul. Buying a home in Snohomish or Seattle is a marathon, not a sprint. Starting the process at least 90 days before you want to move is ideal. Anything sooner than that and you might be leaving yourself in a position to find temporary housing.

Emotional Buying:

Falling in love with a Snohomish property is easy, but let your practical needs guide you. Emotional decisions can lead to overpaying or overlooking flaws. A clear list of must-haves and deal-breakers is your best defense against impulsive buying.

Future-Proofing Your Snohomish Home Investment:

Life changes, and so might your needs. The family-friendly streets of Snohomish and the bustling neighborhoods of Seattle are attractive, but consider how well the home will adapt to potential life changes before making your decision.

Leveraging Professionals:

Going it alone in the real estate market can be daunting. Agents, lawyers, and mortgage brokers bring expertise that can navigate you through the complex process. Use their insights for better terms and a clearer path to your dream home.

If you have plans to move, reach out to The Serviss Group. We’re here to provide the guidance you need to make the home buying process seamless and rewarding.

While the Snohomish real estate and Seattle markets can be challenging for first-time homebuyers, being aware of common mistakes and preparing accordingly will pave the way for a more informed decision, ultimately leading you to the right home that meets your current and future needs.

Need a REALTOR?

Interview The Serviss Group

Debunking Myths in Home Buying: A Snohomish Real Estate Perspective

In this informative blog post, we debunk common myths about home buying, with a special focus on the Snohomish real estate market, providing readers with factual insights and practical advice. From the significance of home inspections to the realities of negotiating in Snohomish's dynamic property landscape, this article is an essential guide for both first-time buyers and seasoned investors.

Debunking Myths in Home Buying: A Snohomish Real Estate Perspective

Whether you're a first-time buyer or a seasoned investor in the property market, this article is designed to provide valuable insights and factual information, ensuring your journey in the Snohomish real estate landscape is grounded in reality, not swayed by common myths.

Myth 1: You Need a 20% Down Payment

Reality: The traditional notion of needing a 20% down payment is not a one-size-fits-all, especially in the dynamic Snohomish real estate market. Many buyers are surprised to find that several programs offer lower down payment options. In Snohomish, for example, there are first-time homebuyer programs and loans like FHA that require as little as 3.5% down. Understanding these options can open doors to homeownership much sooner than many anticipate.

Myth 2: The Best Homes Are Found Offline

Reality: While there's charm in the traditional method of house hunting, the Snohomish real estate market, like many others, is heavily influenced by online listings. These online platforms offer comprehensive details, photos, and even virtual tours, providing a more efficient and broader view of what’s available. Moreover, many listings hit online sites before they make it to print, giving digital-savvy buyers an edge.

Myth 3: Spring Is the Best Time to Buy

Reality: The Snohomish real estate market, like any other, fluctuates throughout the year. While spring brings more listings, it also brings more competition, potentially driving up prices. Buying in off-peak seasons, like fall or winter, might offer better deals with less competition. It's essential to monitor the local Snohomish market trends to identify the best time to make a purchase.

Myth 4: You Don't Need a Real Estate Agent

Reality: Navigating the Snohomish real estate market without a professional can be challenging. A local real estate agent brings valuable insights about the area, understands market trends, and possesses negotiation skills that are crucial in getting the best deal. Their expertise in handling the complexities of contracts and closing processes also ensures a smoother transaction.

Myth 5: Home Inspections Are Optional

Reality: Skipping a home inspection in the Snohomish real estate market can be a costly mistake. Inspections can reveal hidden issues like structural problems, outdated electrical systems, or roofing issues, common in some older Snohomish properties. Addressing these issues early can save buyers from significant expenses and headaches down the road.

Myth 6: Bigger Is Always Better

Reality: In the world of Snohomish real estate, finding a home that suits your lifestyle and needs is more important than its size. A larger home not only costs more upfront but also involves higher maintenance, utility costs, and property taxes. It’s crucial to consider your long-term lifestyle needs and choose a size that’s a comfortable fit.

Myth 7: The Asking Price Is Non-Negotiable

Reality: In the Snohomish real estate market, there’s always room for negotiation. A well-informed buyer can negotiate the price based on factors like market conditions, the property's condition, and how long it's been on the market. Working with a skilled local agent can significantly enhance your negotiation strategy.

Understanding these myths and realities is crucial for anyone navigating the Snohomish real estate market. We encourage all potential buyers to approach the process with an informed and realistic perspective, and not hesitate to seek professional advice for a successful home buying experience.

If you’re looking to dive into the Snohomish real estate market or need more guidance on navigating these myths and realities, don't hesitate to contact us. We're here to help you find your dream home in Snohomish with the right information and expert support.

Need a REALTOR?

Interview The Serviss Group

Unlocking Homeownership: Down Payment Resources in Snohomish and King County

Navigating the path to homeownership in Washington State's Snohomish and King County can be made easier with a variety of down payment resources. From government-backed programs like the WSHFC's Home Advantage to non-traditional methods like crowdfunding, prospective homeowners have multiple avenues to secure their dream home.

Down Payment Resources to Help Buy a Home in Washington State

Buying a home is a significant milestone in anyone's life. In the picturesque landscapes of Washington State, particularly in Snohomish and King County, the dream of homeownership can seem just within reach. However, one of the most significant barriers to this dream is the down payment. Fortunately, there are numerous down payment resources available to prospective homeowners in these counties. This blog post will explore these resources, ensuring that your dream home in Snohomish or King County becomes a reality.

There are programs out there!

1. Washington State Housing Finance Commission (WSHFC)

Home Advantage Program: http://www.wshfc.org/buyers/HomeAdvantage.htm

The WSHFC offers several programs to assist homebuyers with their down payments. One of the most popular is the Home Advantage program. This program provides a second mortgage at 0% interest, which can be used for down payments and closing costs. The funds are deferred, meaning you don't have to make any payments until you sell or refinance your home.

2. Local City and County Programs

ARCH East King County Downpayment Assistance Loan Program: http://www.archhousing.org

Both Snohomish and King County have local programs aimed at assisting homebuyers. For instance, the ARCH East King County Downpayment Assistance Loan Program offers interest-free loans to eligible first-time homebuyers. Similarly, Snohomish County has its Down Payment Assistance Program, providing funds to qualified buyers.

3. FHA Loans

Official FHA Loan Information: https://www.hud.gov/buying/loans

The Federal Housing Administration (FHA) offers loans with a low down payment requirement, often as low as 3.5%. While this isn't a down payment assistance program per se, the reduced requirement can make homeownership more accessible. Many buyers in Snohomish and King County have successfully used FHA loans to purchase their homes.

4. VA Loans

Official VA Loan Information: https://www.va.gov/housing-assistance/home-loans/

For veterans and active-duty military members, VA loans can be a godsend. These loans, backed by the Department of Veterans Affairs, often require no down payment at all. Plus, they come with competitive interest rates, making them an excellent option for those who have served our country.

5. USDA Loans

Official USDA Loan Information: https://www.usda.gov/topics/rural/housing-assistance

While Snohomish and King County are largely urban, there are rural areas where the USDA loan can be applicable. This loan, backed by the United States Department of Agriculture, is designed for rural homebuyers and often requires no down payment.

6. Non-Profit Organizations

HomeSight Program: https://homesightwa.org

Several non-profit organizations offer down payment assistance to homebuyers in Washington State. For instance, the HomeSight program provides financial assistance to qualified buyers in specific areas, including parts of King County.

7. Crowdfunding

HomeFundMe: https://www.homefundme.com

While not a traditional method, many modern homebuyers are turning to crowdfunding platforms like HomeFundMe to gather down payment funds. Friends, family, and even strangers can contribute to your homeownership dream.

8. Family Gifts

Many lenders allow for a portion, if not all, of the down payment to come from gifts from family members. If you have a generous family member willing to help, this can be a viable way to cover your down payment costs.

9. Employer Assistance Programs

Some employers, especially larger ones or those in specific industries, offer down payment assistance as part of their benefits package. It's worth checking with your HR department to see if this is an option for you.

10. Save, Save, Save

While this might seem obvious, the best resource for a down payment is often your savings. Even small contributions to a dedicated savings account over time can add up. Consider automating your savings or using apps that round up your purchases, putting the spare change towards your down payment.

Conclusion

The dream of homeownership in Snohomish and King County is attainable, thanks to the myriad of down payment resources available. From government programs to non-traditional methods like crowdfunding, there's likely a solution that fits your needs. As a realtor, I'm committed to helping you navigate these options, ensuring you find the perfect home in Washington State.

Need a realtor?

See if The Serviss Group can help!

Decoding the Down Payment: Should You Stick to the 20% Rule?

Explore the financial implications of choosing between a 20% down payment and a smaller amount when buying a home in Snohomish, WA. This comprehensive guide breaks down the pros and cons, offering valuable insights for both first-time homebuyers and seasoned investors in the local real estate market.

The Great Debate: Making a 20% Down Payment on Your House or Not?

Buying a house is one of the most significant decisions you'll ever make. It involves a lot of planning, saving, and a big question that looms large: "How much should my initial down payment be?" Traditionally, a 20% down payment has been the golden standard, but is it the right choice for you? Let's delve into the intricacies of making a 20% down payment versus opting for a smaller amount.

The 20% Down Payment

Historically, putting down 20% of the home's purchase price has been seen as a norm. Let's explore the pros and cons of sticking to this tradition.

Advantages:

Lower Monthly Payments: A substantial down payment reduces your monthly mortgage payments, making your household budget more breathable.

Better Mortgage Rates: Lenders often offer more favorable mortgage rates to buyers who can afford a 20% down payment, potentially saving you thousands over the life of the loan.

Building Equity: A higher down payment means you start off with more equity in your home, providing a financial cushion for the future.

Disadvantages:

Higher Upfront Cost: Accumulating 20% of the home's value can be a steep hill to climb, delaying your home ownership dreams.

Less Liquidity: A hefty down payment can tie up a significant portion of your savings, leaving less room for other investments or emergencies.

Less Than 20% Down Payment

In recent years, many have chosen to put down less than 20%. Let's weigh the benefits and drawbacks of this approach.

Advantages:

Getting into a Home Sooner: A smaller down payment means you can become a homeowner sooner rather than later.

Preserving Cash: By not tying up a large sum in your home, you retain cash for other investments or emergencies.

Disadvantages:

Higher Monthly Payments: A smaller down payment results in higher monthly mortgage payments.

Potential for Higher Interest Rates: Lenders might charge higher interest rates if your down payment is less than 20%.

Private Mortgage Insurance (PMI): With a down payment of less than 20%, you'll likely be required to pay PMI, adding to your monthly expenses.

Case Studies/Examples

To better illustrate the implications of your down payment choice, let's delve into two different scenarios with detailed calculations:

Scenario 1: John opts for a 20% down payment

Home Price: $700,000

Down Payment (20%): $140,000

Loan Amount: $560,000

Interest Rate: 6.0%

Loan Term: 30 years

Monthly Payment: $3,358.35 (excluding property taxes and homeowners insurance)

Total Interest Paid over 30 years: $606,005.60

PMI: NoneAdvantages:

Lower monthly payments, saving on interest over time.

No PMI, which can potentially save hundreds of dollars each month.

Scenario 2: Sarah opts for a 10% down payment

Home Price: $700,000

Down Payment (10%): $70,000

Loan Amount: $630,000

Interest Rate: 6.0%

Loan Term: 30 years

Monthly Payment: $3,778.83 (excluding property taxes and homeowners insurance)

Total Interest Paid over 30 years: $680,176.80

PMI: Approximately $200 per month for the first several years (until 20% equity is reached)Advantages:

Sarah can become a homeowner sooner, with a lower initial down payment.

She retains more of her savings for other investments or emergencies.

Financial Implications Over Time:

Interest Savings: By opting for a 20% down payment, John saves $74,171.20 in interest over the life of the loan compared to Sarah.

PMI Costs: Sarah incurs additional costs due to PMI, which can add up significantly over time until she reaches 20% equity in her home.

Equity Building: John starts with a higher equity in his home, providing a financial cushion and the ability to potentially access this equity through loans or lines of credit in the future.

Both scenarios have their own set of advantages and trade-offs. John enjoys lower monthly payments and saves on interest and PMI costs over time, but he also ties up a larger sum of money upfront. On the other hand, Sarah is able to enter the housing market sooner, albeit with higher monthly payments and additional PMI costs.

Helpful Resources

To aid you in making an informed decision, here are some resources you might find useful:

Mortgage Calculators - to help you crunch the numbers.

Down Payment Articles - for a deeper understanding of down payments.

Choosing the right down payment amount is a highly personal decision influenced by your financial circumstances, market conditions, and long-term goals. Whether you opt for a 20% down payment or a smaller amount, the most important factor is choosing a path that aligns with your financial stability and home ownership dreams.

We'd love to hear from you! Share your thoughts or experiences in the comments section below. If you're grappling with the down payment dilemma, feel free to reach out for personalized advice.

Need a realtor?

See if The Serviss Group can help!

How to Buy Land Like a Pro - A Checklist to Buy Land to Build a House

When researching to purchase land, you’ll want to get all the information you can upfront and during the escrow process. For one, it will help eliminate properties that won’t work for you, and two, it will help reduce unexpected costs or unexpected failed plans.

How To Buy Land Like a Pro

When researching to purchase land, you’ll want to get all the information you can upfront and during the escrow process. For one, it will help eliminate properties that won’t work for you, and two, it will help reduce unexpected costs or unexpected failed plans.

Simple enough, right? Once you start, you soon realize there is a LOT more to buying land than you might think. This guide should give you a good head start on what to learn before you go the land route.

If you have questions or get overwhelmed by the process and need a REALTOR to help guide you through the process, The Serviss Group is here to help.

We have a 13 page document to share with you that outlines in detail all the steps you need to take to make sure a piece of land is right for you.

Get the 13-page “How To Buy Land Like a Pro” guide below

Here’s teaser…

What’s is GIS?

How to find parcel owner names and addresses

How to discover land conditions like mortgages, liens, title issues, unpaid taxes, tax rates, roll-back taxes, foreclosures, deed restrictions, easements, and access.

Have any mineral or air rights been sold or leased?

How to learn more about the topography, impervious services, flood zones + FEMA

Understanding the types of deeds

Why surveys are important and all the different types

The importance of soil testing

Understanding land zoning and density zoning

Minerals, oils, and gas

Water and sewer or is will it be septic and well?

How to understand CC&Rs and where to find them

And I’m not joking… so much more!

Fill out the form below and you get a link to the document. You can download the file by going to file>download. I will also email you a copy.

Need a realtor?

See if The Serviss Group can help!

Everything You Need to Sell Your House - A (FREE) Seminar for Homeowners

Panelist of top industry experts here to answer all your home selling questions. We help you avoid the most common mistakes sellers make!

Everything You Need to Sell Your House - A (FREE) Seminar for Homeowners

Panelist of top industry experts here to answer all your home selling questions. We help you avoid the most common mistakes sellers make!

Come join us for an open Q & A with top industry experts.

This seminar is 100% free. We want to help educate the WA state homeowner so you can avoid the mistakes other sellers make.

Guests that pre-register get a gift card to Arena Sports (where the event is held) to either play some games afterwards, or bring your kids and let them have some fun while you attend the 60 minute seminar.

The panelists will be guided by Managing Broker/Realtor, Nicole Serviss. She leads a Platinum Award Level team in the Snohomish County area and works with buyers, sellers, and investors. Ask questions like:

What to fix to get your home ready to sell?

What are the top mistakes sellers make?

Is it a good time to sell?

What is the market doing right now?

Hear from a financial advisor.

Why invest your money?

How to use your home equity to your advantage?

What is capital gains tax?

What is excise tax?

Ask a title officer questions about taking title to a property.

What is a POA?

How is my home deeded?

How do I find out if I have any judgement liens?

What if I own multiple parcels?

What if there are legal issues that need to be addressed?

We'll have a mortgage broker. Ask about your budget for your move.

What is a pre-approval vs. a pre-qualification?

What is the best way to leverage my net proceeds towards the down payment on the next home in a higher rate environment?

What is a Seller Buydown strategy?

Is it better to offer a seller credit or price reduction?

About the venue:

Arena Sports Mill Creek has indoor activities for everyone — Ropes Course, Climbing Walls, Classic Bowling, Arcade & Virtual Reality Games, Laser Tag, Mini Bowling, Inflatable FunZone and a restaurant!

Light food provided.

Need a realtor?

See if The Serviss Group can help!

Moving to Snohomish? Don't Go Tour a House Until You Do These 3 Things

Moving to Snohomish? Don't Go Tour a House Until You Do These 3 Things

Moving to Snohomish? Don't Go Tour a House Until You Do These 3 Things

I've got a list for you guys that I will make the actual home shopping process go much faster.

You don’t want to waste your time (that you could be spending doing much more fun things) on houses that are big NOs!

Look up the house on Google Maps

Start with the satellite view and get a feel for the neighborhood and what’s around you. Sometimes when you're just looking at just the street address you don't realize that behind the the property is a maybe a construction company, or a landscaping company, or school. You can find positive things by looking at the satellite view and also maybe some negative things.

I also want you to try to look at the street view if it's available. Sometimes in more rural areas the street view isn’t available, but if you see that little glowing blue line, drag that little street-view guy there take a look around before you spend the time to get in your car and spend money on gas.

Read the Seller’s Disclosure

The seller disclosure is the seller telling you, to the best of their knowledge, what's wrong with their house along with some of its history. If there is a clear history of maybe flooding in the basement or roof is leaking and maybe that's not within your budget, well don't spend your time driving out to this house to go see it inside if you already know you're taking it off your list.

Take the time to read the seller's disclosure. The public does not have access to this form, so reach out to your real estate agent (if you don't have one, give me a call) and we'll get you a copy of that so you can preview it.

Look at the 3D Tour

If there's a virtual tour recorded of the house, absolutely look through it. If there’s a video, look at that too, but the 3D virtual tours are easier to control and give you a better idea of placement of rooms. Some of them you can actually measure room distances, so if it's really important to you to be able to fit a king-size bed in the master bedroom, you can measure that out and see how big the space is.

It's hard on pictures to see where each room is located and where that mystery door leads to. Is that door leading to a closet? Is that another bedroom? Is that the garage? That virtual tour will give you the lay of the land.

Do a Drive By

Sometimes you pull up to the curb and before you even walk in the front door you look around realize this is not the house for you. Maybe it doesn't really fit what you're needing for your family. If that's something that could have been eliminated before you take time off work and meet your real estate agent down at the house, go do a drive-by to get a feel for what's around there.

If it's really important to you to have walkability and you pull up and you realize this neighborhood has no sidewalks, well then don't waste your time looking at that house.

Your time is valuable. You don't want to spend it on on properties that would already be a no if you did these first steps.

I hope this was helpful, and it makes your house hunting process a little bit easier.

Need a realtor?

See if The Serviss Group can help!

Georgetown Estates, Emerald Forest, Kensington Estates Homes for Sale - Get The List!

Have you always wanted to move to Emerald Forest/Georgetown Estates? I’ve put together a list of every home in that area.

Want to move to Emerald Forest, Georgetown Estates, Greenview Farms, or Kensington Estates area?

Nicole Serviss, RE/MAX Elite

Have you always wanted to move to Emerald Forest/Georgetown Estates? I’ve put together a list of every home in that area. Submit the quick and easy form for your copy of the complete list and to register for an updated list to be sent daily.

Do you currently live in this neighborhood and want a (free) home valuation? Click the button below.

Large Homes for Sale in the Snohomish Area - Get The List!

Dream of owning a bigger house? I’ve put together a list of every home in the Snohomish area with room to play.

Every Large Home for Sale in the Snohomish Area

Nicole Serviss, RE/MAX Elite

Have the dream of owning a larger home? I’ve put together a list of every home in the Snohomish area with plenty of space to play. Submit the quick and easy form for your copy of the complete list and to register for an updated list to be sent daily.

What it's like in the Million Dollar Market

When a neighborhood has never seen a million-dollar sale, it can be scary for a buyer to cross over that threshold. Their agent is probably advising them that there could be issues getting their financing through the appraisal process because there might not be other homes to support this new price jump. Like the old adage, you don't want the best house in the worst neighborhood.

When a neighborhood has never seen a million-dollar sale, it can be scary for a buyer to cross over that threshold. Their agent is probably advising them that there could be issues getting their financing through the appraisal process because there might not be other homes to support this new price jump. Like the old adage, you don't want the best house in the worst neighborhood.

Right now in the Seattle area market, homes are selling for an average of 6-10% over list price. A savvy seller (and Realtor) knows this and will want to price their home to reflect that, so we often see homes underpriced on purpose to reflect buyer'’ expectations. We see many million-dollar homes priced in the $900,000s.

Homes in the Western Region of Washington have seen a 21.1% increase in the median price in just 12 months due to high demand and low supply. A lot of buyers have had to bump up their budget into the million-dollar range to get what they want.

I find that million-dollar buyers have very specific needs in their home search and are in a position to wait to find the right one. They often don't need to move or sell first in order to upsize to their next home. They have the luxury to wait. It's taking these buyers much longer to find a home to purchase because they can afford to be a little pickier.

When the buyer is right at the million-dollar mark, they are still being very accommodating to sellers. We've been offering free rent-backs, no seller-paid closing costs, and waiving appraisals. If a buyer is in a position to have a home inspection, meaning they were not in a multiple offer situation and needed to waive inspection, they're not asking for a lot. They're sticking to the big-ticket items like roofs, crawlspace, etc.

Get my (free) Guide

Where I show you how I help families move up to the home that better fits their needs.

What is Earnest Money?

In Washington State, our real estate contracts are designed to protect the buyer's earnest money, as long as the buyer follows the terms of the contract. It's important for a buyer to do their due diligence in all areas before committing 100% to a home.

My name is Nicole Serviss and I’m a REALTOR® who helps families north of Seattle invest in real estate so that they can upsize to the house of their dreams.

In Washington State, our real estate contracts are designed to protect the buyer's earnest money, as long as the buyer follows the terms of the contract. It's important for a buyer to do their due diligence in all areas before committing 100% to a home.

We have contingencies for reviewing HOA documents, inspections, listing information, title reports, etc. Having a knowledgeable REALTOR® by your side will help the buyer better understand the risks involved with each unique property. As long as you terminate your contract within the agreed timeframe, you'll get your earnest money back.

Many buyers in this competitive market are opting to make their earnest money deposits non-refundable and immediately released to the seller. This makes their offer more desirable, but can be nearly impossible to recover those funds unless the seller defaults on the terms of the contract.

I would encourage any buyer making an offer to make sure you have a skilled REALTOR® who will answer any and all their questions. Read every document sent to you and read it thoroughly. Ask your agent to guide you on where to look for the information you don't currently have, and take the time to understand the information you find. I would also add that I'd never offer more earnest money than I was willing to lose.

Get my (free) Guide

Where I show you how I help families move up to the home that better fits their needs.

Tips to Stage Your Home for Sale

My name is Nicole Serviss and I’m a REALTOR® who helps families buy and sell real estate so that they can upsize to the house of their dreams. It’s my passion to help you get the most for your home so that you can use that money to help you move onto your next home.

My name is Nicole Serviss and I’m a REALTOR® who helps families buy and sell real estate so that they can upsize to the house of their dreams. It’s my passion to help you get the most for your home so that you can use that money to help you move onto your next home.

Staging is KEY to that.

The ideal situation would be to move out of your home and have it professionally staged. However, not everyone has that option. Here are my best tips to get you top dollar when you need to continue living in the home while it's listed on the market.

First, think about "hotel style." Keep things generic, simple, and clean. If you have to say to yourself, "that's my personal taste," then you probably need to replace that item with something that most people would love. Remember, it's not about you anymore. Keep the decor to a minimum. It should accent the space, not take it over.

You want to mentally move out of your home before it even hits the market. Your space is no longer your space. Remove all items that are personal to you or your family. Remove anything that has your family name or photo. You don't want that potential buyer walking into your home and feeling like they've invaded your space.

You want that buyer to walk in and imagine themselves living there. That's the power of staging.

Get my (free) Guide

Where I show you how I help families move up to the home that better fits their needs.

Snohomish County Real Estate Market Update

Let’s look at the 2021 real estate market and see what it’s telling us about what to expect in 2022.

Snohomish County Real Estate Market Update

Snohomish County Housing Market

Updated for Winter/Spring 2022

Nicole Serviss, RE/MAX Elite

December 2021 Data

Home prices had already started to rise before the pandemic, but the pandemic created a rapid acceleration. In 2021, we saw the median home price increase by 22.5%, going from $571k to $700k.

Even Zillow predicted a strong real estate market this year and we got one.

Why the huge increase in prices? LOW INVENTORY.

We don’t have enough homes for sale. This makes for more competition between buyers to WIN the house in a bidding war, driving prices up.

Should we expect the same growth this year?

We still don't have enough homes on the market to cause a big shift. I would expect to continue to see prices rise over the next year.

Should wait for prices to drop before buying a house? No. We probably won’t see prices drop this year.

Interest rates are still very low but they are rising so your buying power is decreasing.

Love a good visual?

See the graphs below.

Median Sales Price —— Increased over the course of the year.

Homes for Sale —- Trending downward. We need more houses to come on the market for the market to balance out.

Median Price Per Square Foot —- Increased. As a seller, you’re getting more for your house now than ever before.

Curious to see what your house would sell for?

Interest Rates — Why They Play A Big Role

Here are the current national rates.

For now, rates are still low but they’re rising.

FAQS

Why have prices increased?

When you have a low number of homes for sale and a high demand for homes from buyers, you get buyers competing with each other to win. One of the best ways to do that is to offer to pay more money. Every time this happens, this helps the next future house sell for more as well because the overall value of the area increases.

Have a question you want answered?

You might be interested in…

I've Been Featured in Home.com - Should Sellers Accept VA Offers? Yes. Here Are Five Reasons Why.

Thank you Home.com for reaching out and asking me to share my expertise as a REALTOR.

Should Sellers Accept VA Offers? Yes. Here Are Five Reasons Why.

September 2021

Nicole Serviss, RE/MAX Elite

&

Erik Martin, Home.com Contributor

Thank you Home.com for reaching out and asking me to share my expertise as a REALTOR. Here’s what I said:

“Because they don’t need to put any money down on the loan, these buyers often have more cash at their disposal to pay for their closing costs or appraisal differences.”

“One of the most rewarding things about accepting an offer with a VA loan is knowing that you are showing a veteran that you appreciate his or her service,” Serviss said. “It can seem like a small gesture, but it can have a huge impact on that service member or veteran.”

They can negotiate with the buyer to find a number that works for both parties. However, the seller must pay a portion of the buyer’s escrow fee, according to REALTOR® Nicole Serviss, and the cost can vary from state to state.

The whole article is a very thorough rundown of everything you need to know about why you should accept an offer with a VA loan. See the full article —> HERE

Nicole Serviss, Broker and REALTOR with RE/MAX Elite

Let me know if I can help you purchase a home.

You might be interested in…

I've Been Featured in The Epoch Times - Inflation and the Price of Goods

Thank you Epoch Times for reaching out and asking me to share my expertise as a REALTOR. Here’s what I said:

Inflation and the Price of Goods: What to Buy Now and What to Avoid

August 2021

Nicole Serviss, RE/MAX Elite

Thank you Epoch Times for reaching out and asking me to share my expertise as a REALTOR. Here’s what I said:

Large purchases such as homes can trigger extra stress when prices are climbing.

“Some buyers are being priced out of their desired areas,” Nicole Serviss, a realtor in the Seattle area, told The Epoch Times.

“In some cases, it’s better to overpay for a home now just to guarantee you’ll be able to buy one, than to wait,” she said.

If your timeline is flexible, however, you may decide to home shop next year to evaluate prices. You’ll also want to consider interest rates on mortgages and monthly payments to see if the amount fits into your budget.

The whole article is a very thorough rundown of everything you need to know about what to buy now and what to avoid in an inflated market. See the full article —> HERE

Nicole Serviss, Broker and REALTOR with RE/MAX Elite

Let me know if I can help you purchase a home.

You might be interested in…

I've Been Featured in The Ultimate Guide of How to Become a Landlord

Thank you Steadily for reaching out and asking me to share my experiences as a landlord. Here’s what I said.

Thank you Steadily for reaching out and asking me to share my experiences as a landlord. Here’s what I said:

“I bought my first home at a very young age. 4 kids later, my family quickly outgrew that 1200 sqft home. When it was time to upsize, I had a decision to make: keep or sell.

Being located in a military town, it was an easy decision to make it a rental. It was about 90 minutes away from my new home, so I had a management company handle things for me. After years of positive cash flow, I eventually sold that single-family home and used the funds in a 1031 exchange to buy a duplex closer to my new home.

With my new duplex so close to me, I could now manage it myself and increase my monthly cash flow. I became a member of my state landlord association and that has been pivotal in making this new venture a success. They provide leases, updates on landlord-tenant laws, tenant screening, and support. I have a great group of mentors that have helped me make this landlord venture a success. I’m always on the lookout for more rentals and

look forward to being a great landlord/businesswoman for future tenants.”

The whole article is a very thorough rundown of everything you need to know to become a landlord. See the full article —> HERE

Nicole Serviss, Broker and REALTOR with RE/MAX Elite

Let me know if I can help give you an estimated value of your investment property.

You might be interested in…

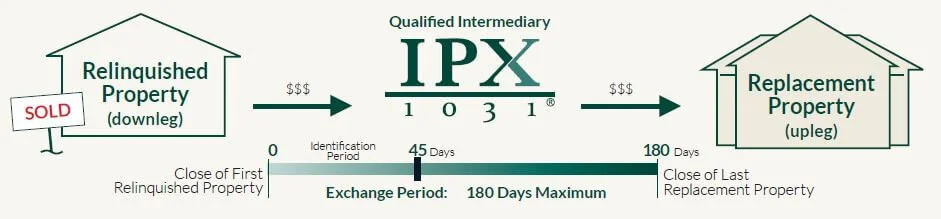

1031 Exchange Trends and Info for 2021 With Guest Writer Kyle Williams IPX1031

Like Kind Exchanges, also known as tax deferred exchanges, are defined by Internal Revenue Code (IRC) section 1031. A 1031 Tax Deferred Exchange offers taxpayers one of the last great opportunities to build wealth and save taxes. Find out more about this service to help you keep more money in your pocket when you go to sell your investment property.

Please welcome our guest writer, Kyle Williams with 1031 IPX Exchange.

January 2021

Nicole Serviss, RE/MAX Elite

Kyle Williams, IPX1031

First of all, what is a 1031 Exchange?

Like Kind Exchanges, also known as tax deferred exchanges, are defined by Internal Revenue Code (IRC) section 1031. A 1031 Tax Deferred Exchange offers taxpayers one of the last great opportunities to build wealth and save taxes. By completing a 1031 Exchange, the Taxpayer (“Exchanger”) can dispose of investment or business-use assets, acquire replacement property and defer the tax that would ordinarily be due upon the sale.

2020 was yet again another record year for 1031 Exchanges.

What’s in store for 2021?

Commercial real estate is predicted to have a mixed forecast in 2021 with certain sectors, such as industrial, experiencing robust growth while others continue to struggle. With low interest rates expected to continue and the economy recovering, many CRE sectors should normalize by mid to late 2021 if the vaccines are widely available.

Another strong year for 1031 Tax Deferred Exchange transactional activity is anticipated in 2021. Two factors will drive significant transactional activity. First, borrowing rates remain historically low. Second, the pandemic has created an unprecedented need to repurpose and renovate commercial real estate to meet post-pandemic business models.

Particularly impacted are office, retail and hotel properties, given the successes of widespread working from home and use of virtual meeting technology. Even multi-family and single family rental properties now need space for use as a home office.

Section 1031 Like-Kind Exchanges provide incentive for owners who are not in a position to make significant building modifications to transfer properties into the hands of buyers willing and able to invest fresh capital and take these properties to their highest and best use for future tenant needs.

Given the dueling pandemic and economic crises, major tax reform does not appear to be a current priority of the new Administration. Nevertheless, the need to pay for pandemic relief and new legislative initiatives could make Section 1031 a target for tax revenue seekers. Our efforts to educate our policy makers to the legitimate, economically important benefits of Section 1031 continue.

1031 trends we are anticipating:

Continued 1031 growth in industrial, self-storage, R&D, medical/office, and multi-family sectors.

Individual exchangers will continue to sell investment property and purchase Replacement Property in warmer climates or other locations with high vacation rental income.

Continued increase of Replacement Property purchases of qualifying vacation home rental properties.

An uptick in Build-to-Suit Exchanges where clients make improvements to their Replacement Properties.

Reverse Exchange momentum will continue to grow with a shortage of Replacement Property inventory and a competitive buyers market.

Retirement/Estate planning with Exchanged property will drive much investor 1031 transactional activity.

Especially while the interest rates on financing are low and favorable, more taxpayers maximizing their 1031 tax deferral potential to grow their portfolios by selling while prices stay high, preserving their equity by using all proceeds to exchange into the purchase of larger or multiple Replacement Properties.

With expected recovery and overall growth in investment and commercial real estate transactions, we are forecasting another strong year for 1031 Tax Deferred Exchange transactional activity.

A 1031 Exchange transaction requires planning, expertise and support.

Here’s a checklist outlining key steps in your exchange.

Choose your 1031 Qualified Intermediary (QI)

Consult with your tax professionals

Include Cooperation Clause language in your purchase and sale agreement

QI prepares your exchange documents

Start searching for Replacement Property

Sign all documents QI prepares

Sell your Relinquished Property

Identify your Replacement Property

Enter into contract on Replacement Property

Contact QI once Replacement Property escrow is opened

Close on Replacement Property

QI transfers funds to complete your purchase

Your exchange is complete

Thank you Kyle and IPX1031 for sharing this great information! His contact info is below. Please reach out to him if you have plans to sell your investment property (land, multi-family, rental house, commercial space) and tell him Nicole Serviss sent you!

Kyle Williams, Vice President and Account Executive with Investment Property Exchange Services, Inc.

responsible for IPX1031 sales covering Washington state. With over 15 years of financial brokerage and real estate experience, including REITs, 1031 Tax Deferred Exchanges, 1031 Exchange rules and regulations, and other real estate investments, he enjoys speaking with brokers, CPAs, attorneys, investors, and real estate professionals. Kyle received his B.A. from The Central Washington University in Political Science and History.

Nicole Serviss, Broker and REALTOR with RE/MAX Elite

Let me know if I can help give you an estimated value of your investment property.

You might be interested in…

Snohomish Homes for Sale - Get Notified Instantly When a New Home Hits The Market

Dream of owning your own Snohomish property? Get notified the instant a new home in Snohomish hits the market.

Snohomish Homes for Sale

Get Notified Instantly When a New Home Hits The Market

Nicole Serviss, RE/MAX Elite

Have the dream of owning a home in Snohomish? I’ve put together a list of every home available and can text you the instant a new one hits the market. Submit the quick and easy form for your copy of the complete list and to register for to receive real time listings in your price range.

Professional staging in Snohomish helps your home sell faster and for more. Learn why Nicole Serviss includes it in her listings, and how it boosts results.