LEARN MORE ABOUT THE LOCAL MARKET.

Snohomish County Real Estate Market Update

Let’s look at the 2021 real estate market and see what it’s telling us about what to expect in 2022.

Snohomish County Real Estate Market Update

Snohomish County Housing Market

Updated for Winter/Spring 2022

Nicole Serviss, RE/MAX Elite

December 2021 Data

Home prices had already started to rise before the pandemic, but the pandemic created a rapid acceleration. In 2021, we saw the median home price increase by 22.5%, going from $571k to $700k.

Even Zillow predicted a strong real estate market this year and we got one.

Why the huge increase in prices? LOW INVENTORY.

We don’t have enough homes for sale. This makes for more competition between buyers to WIN the house in a bidding war, driving prices up.

Should we expect the same growth this year?

We still don't have enough homes on the market to cause a big shift. I would expect to continue to see prices rise over the next year.

Should wait for prices to drop before buying a house? No. We probably won’t see prices drop this year.

Interest rates are still very low but they are rising so your buying power is decreasing.

Love a good visual?

See the graphs below.

Median Sales Price —— Increased over the course of the year.

Homes for Sale —- Trending downward. We need more houses to come on the market for the market to balance out.

Median Price Per Square Foot —- Increased. As a seller, you’re getting more for your house now than ever before.

Curious to see what your house would sell for?

Interest Rates — Why They Play A Big Role

Here are the current national rates.

For now, rates are still low but they’re rising.

FAQS

Why have prices increased?

When you have a low number of homes for sale and a high demand for homes from buyers, you get buyers competing with each other to win. One of the best ways to do that is to offer to pay more money. Every time this happens, this helps the next future house sell for more as well because the overall value of the area increases.

Have a question you want answered?

You might be interested in…

I've Been Featured in Home.com - Should Sellers Accept VA Offers? Yes. Here Are Five Reasons Why.

Thank you Home.com for reaching out and asking me to share my expertise as a REALTOR.

Should Sellers Accept VA Offers? Yes. Here Are Five Reasons Why.

September 2021

Nicole Serviss, RE/MAX Elite

&

Erik Martin, Home.com Contributor

Thank you Home.com for reaching out and asking me to share my expertise as a REALTOR. Here’s what I said:

“Because they don’t need to put any money down on the loan, these buyers often have more cash at their disposal to pay for their closing costs or appraisal differences.”

“One of the most rewarding things about accepting an offer with a VA loan is knowing that you are showing a veteran that you appreciate his or her service,” Serviss said. “It can seem like a small gesture, but it can have a huge impact on that service member or veteran.”

They can negotiate with the buyer to find a number that works for both parties. However, the seller must pay a portion of the buyer’s escrow fee, according to REALTOR® Nicole Serviss, and the cost can vary from state to state.

The whole article is a very thorough rundown of everything you need to know about why you should accept an offer with a VA loan. See the full article —> HERE

Nicole Serviss, Broker and REALTOR with RE/MAX Elite

Let me know if I can help you purchase a home.

You might be interested in…

I've Been Featured in The Epoch Times - Inflation and the Price of Goods

Thank you Epoch Times for reaching out and asking me to share my expertise as a REALTOR. Here’s what I said:

Inflation and the Price of Goods: What to Buy Now and What to Avoid

August 2021

Nicole Serviss, RE/MAX Elite

Thank you Epoch Times for reaching out and asking me to share my expertise as a REALTOR. Here’s what I said:

Large purchases such as homes can trigger extra stress when prices are climbing.

“Some buyers are being priced out of their desired areas,” Nicole Serviss, a realtor in the Seattle area, told The Epoch Times.

“In some cases, it’s better to overpay for a home now just to guarantee you’ll be able to buy one, than to wait,” she said.

If your timeline is flexible, however, you may decide to home shop next year to evaluate prices. You’ll also want to consider interest rates on mortgages and monthly payments to see if the amount fits into your budget.

The whole article is a very thorough rundown of everything you need to know about what to buy now and what to avoid in an inflated market. See the full article —> HERE

Nicole Serviss, Broker and REALTOR with RE/MAX Elite

Let me know if I can help you purchase a home.

You might be interested in…

I've Been Featured in The Ultimate Guide of How to Become a Landlord

Thank you Steadily for reaching out and asking me to share my experiences as a landlord. Here’s what I said.

Thank you Steadily for reaching out and asking me to share my experiences as a landlord. Here’s what I said:

“I bought my first home at a very young age. 4 kids later, my family quickly outgrew that 1200 sqft home. When it was time to upsize, I had a decision to make: keep or sell.

Being located in a military town, it was an easy decision to make it a rental. It was about 90 minutes away from my new home, so I had a management company handle things for me. After years of positive cash flow, I eventually sold that single-family home and used the funds in a 1031 exchange to buy a duplex closer to my new home.

With my new duplex so close to me, I could now manage it myself and increase my monthly cash flow. I became a member of my state landlord association and that has been pivotal in making this new venture a success. They provide leases, updates on landlord-tenant laws, tenant screening, and support. I have a great group of mentors that have helped me make this landlord venture a success. I’m always on the lookout for more rentals and

look forward to being a great landlord/businesswoman for future tenants.”

The whole article is a very thorough rundown of everything you need to know to become a landlord. See the full article —> HERE

Nicole Serviss, Broker and REALTOR with RE/MAX Elite

Let me know if I can help give you an estimated value of your investment property.

You might be interested in…

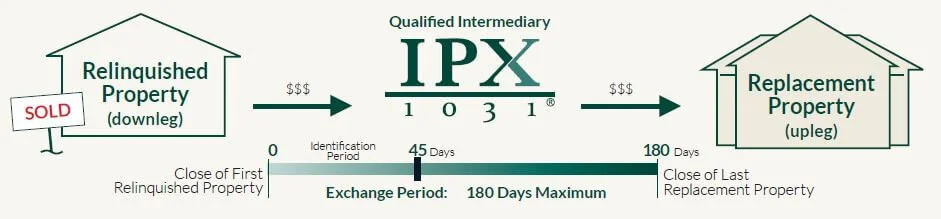

1031 Exchange Trends and Info for 2021 With Guest Writer Kyle Williams IPX1031

Like Kind Exchanges, also known as tax deferred exchanges, are defined by Internal Revenue Code (IRC) section 1031. A 1031 Tax Deferred Exchange offers taxpayers one of the last great opportunities to build wealth and save taxes. Find out more about this service to help you keep more money in your pocket when you go to sell your investment property.

Please welcome our guest writer, Kyle Williams with 1031 IPX Exchange.

January 2021

Nicole Serviss, RE/MAX Elite

Kyle Williams, IPX1031

First of all, what is a 1031 Exchange?

Like Kind Exchanges, also known as tax deferred exchanges, are defined by Internal Revenue Code (IRC) section 1031. A 1031 Tax Deferred Exchange offers taxpayers one of the last great opportunities to build wealth and save taxes. By completing a 1031 Exchange, the Taxpayer (“Exchanger”) can dispose of investment or business-use assets, acquire replacement property and defer the tax that would ordinarily be due upon the sale.

2020 was yet again another record year for 1031 Exchanges.

What’s in store for 2021?

Commercial real estate is predicted to have a mixed forecast in 2021 with certain sectors, such as industrial, experiencing robust growth while others continue to struggle. With low interest rates expected to continue and the economy recovering, many CRE sectors should normalize by mid to late 2021 if the vaccines are widely available.

Another strong year for 1031 Tax Deferred Exchange transactional activity is anticipated in 2021. Two factors will drive significant transactional activity. First, borrowing rates remain historically low. Second, the pandemic has created an unprecedented need to repurpose and renovate commercial real estate to meet post-pandemic business models.

Particularly impacted are office, retail and hotel properties, given the successes of widespread working from home and use of virtual meeting technology. Even multi-family and single family rental properties now need space for use as a home office.

Section 1031 Like-Kind Exchanges provide incentive for owners who are not in a position to make significant building modifications to transfer properties into the hands of buyers willing and able to invest fresh capital and take these properties to their highest and best use for future tenant needs.

Given the dueling pandemic and economic crises, major tax reform does not appear to be a current priority of the new Administration. Nevertheless, the need to pay for pandemic relief and new legislative initiatives could make Section 1031 a target for tax revenue seekers. Our efforts to educate our policy makers to the legitimate, economically important benefits of Section 1031 continue.

1031 trends we are anticipating:

Continued 1031 growth in industrial, self-storage, R&D, medical/office, and multi-family sectors.

Individual exchangers will continue to sell investment property and purchase Replacement Property in warmer climates or other locations with high vacation rental income.

Continued increase of Replacement Property purchases of qualifying vacation home rental properties.

An uptick in Build-to-Suit Exchanges where clients make improvements to their Replacement Properties.

Reverse Exchange momentum will continue to grow with a shortage of Replacement Property inventory and a competitive buyers market.

Retirement/Estate planning with Exchanged property will drive much investor 1031 transactional activity.

Especially while the interest rates on financing are low and favorable, more taxpayers maximizing their 1031 tax deferral potential to grow their portfolios by selling while prices stay high, preserving their equity by using all proceeds to exchange into the purchase of larger or multiple Replacement Properties.

With expected recovery and overall growth in investment and commercial real estate transactions, we are forecasting another strong year for 1031 Tax Deferred Exchange transactional activity.

A 1031 Exchange transaction requires planning, expertise and support.

Here’s a checklist outlining key steps in your exchange.

Choose your 1031 Qualified Intermediary (QI)

Consult with your tax professionals

Include Cooperation Clause language in your purchase and sale agreement

QI prepares your exchange documents

Start searching for Replacement Property

Sign all documents QI prepares

Sell your Relinquished Property

Identify your Replacement Property

Enter into contract on Replacement Property

Contact QI once Replacement Property escrow is opened

Close on Replacement Property

QI transfers funds to complete your purchase

Your exchange is complete

Thank you Kyle and IPX1031 for sharing this great information! His contact info is below. Please reach out to him if you have plans to sell your investment property (land, multi-family, rental house, commercial space) and tell him Nicole Serviss sent you!

Kyle Williams, Vice President and Account Executive with Investment Property Exchange Services, Inc.

responsible for IPX1031 sales covering Washington state. With over 15 years of financial brokerage and real estate experience, including REITs, 1031 Tax Deferred Exchanges, 1031 Exchange rules and regulations, and other real estate investments, he enjoys speaking with brokers, CPAs, attorneys, investors, and real estate professionals. Kyle received his B.A. from The Central Washington University in Political Science and History.

Nicole Serviss, Broker and REALTOR with RE/MAX Elite

Let me know if I can help give you an estimated value of your investment property.

You might be interested in…

2021 Real Estate Market Forecast - Snohomish County - Will it Crash or Boom Again?

2020 Real Estate Market Annual Review and 2021 Predictions. Let’s look at the 2020 real estate market and see what it’s telling us about what to expect in 2021.

What the 2020 Real Estate Market Will Tell Us about 2021 - My Predictions

Will it crash or boom again?

Snohomish County Housing Market

January 2021

Nicole Serviss, RE/MAX Elite

Despite the tumultuous year, the housing market saw a large boom in 2020. We had a short pause in the spring when the lockdowns first began, but the year ended with record breaking sales.

Sales continue to rise along with house prices. Millions of people throughout the country were laid off or furloughed, but it didn’t stop the house hunters from buying homes.

Home prices had already started to rise before the pandemic, but the pandemic created a rapid acceleration. We saw the average home prices increase by 15% in some areas of Snohomish County going from $554,879 to $630,769 in 2020.

Even Zillow is prediction a strong real estate market for 2021. Even with the large boom in 2020, they are still expecting to see a 10% growth in prices in 2021.

Why the huge increase in prices? LOW INVENTORY.

We don’t have enough homes for sale. This makes for more competition between buyers to WIN the house in a bidding war, driving prices up.

Should we expect the same growth in 2021?

Yes and no. We will continue to see home prices rise, but a little more slowly.

Does this mean you should wait for prices to drop before buying a house? No. We probably won’t see prices drop this year.

Interest rates are still very low so you can get more house for your money because it is so cheap to borrow right now.

Love a good visual? See the graphs below showing 2020’s data.

Median Sales Price —— Increased over the course of the year.

Homes for Sale —- Increased at the start of the year and then rapidly declined to where there are hardly any houses left.

Median Price Per Square Foot —- Increased. You are getting less house for your money.

Interest Rates — Why They Play A Big Role

Checking out the chart, you can see how rates have continued to decrease over the course of the year (minus this little dip here as we get into January). Will they continue to rise or go back down?

Election years always produce nice low rates, and 2020 was no exception.

For now, rates are still really low and give you, the buyer, more power to purchase a higher priced house while still keeping your monthly payment affordable.

“Some economists forecast that rates will break the 3% range in 2021, but not rise much higher than 3.1% to 3.3%.

The Mortgage Bankers Association (MBA) says it believes the average rate for a 30-year mortgage will start at 2.9% in the first quarter of 2021 and gradually increase to 3.2% by the end of 2021.” Source, Forbes.com

How does this affect you?

If you’re a home seller—This means you have a lot of buyers that can leverage more buying power because their monthly payments are much lower at this rate than the rates last year.

If you’re a potential buyer—You can use this time to borrow money and even though home prices have risen, your monthly payment might not because of these low rates.

FAQS

Why have prices increased?

When you have a low number of homes for sale and a high demand for homes from buyers, you get buyers competing with each other to win. One of the best ways to do that is to offer to pay more money. Every time this happens, this helps the next future house sell for more as well because the overall value of the area increases.

Have a question you want answered?

You might be interested in…

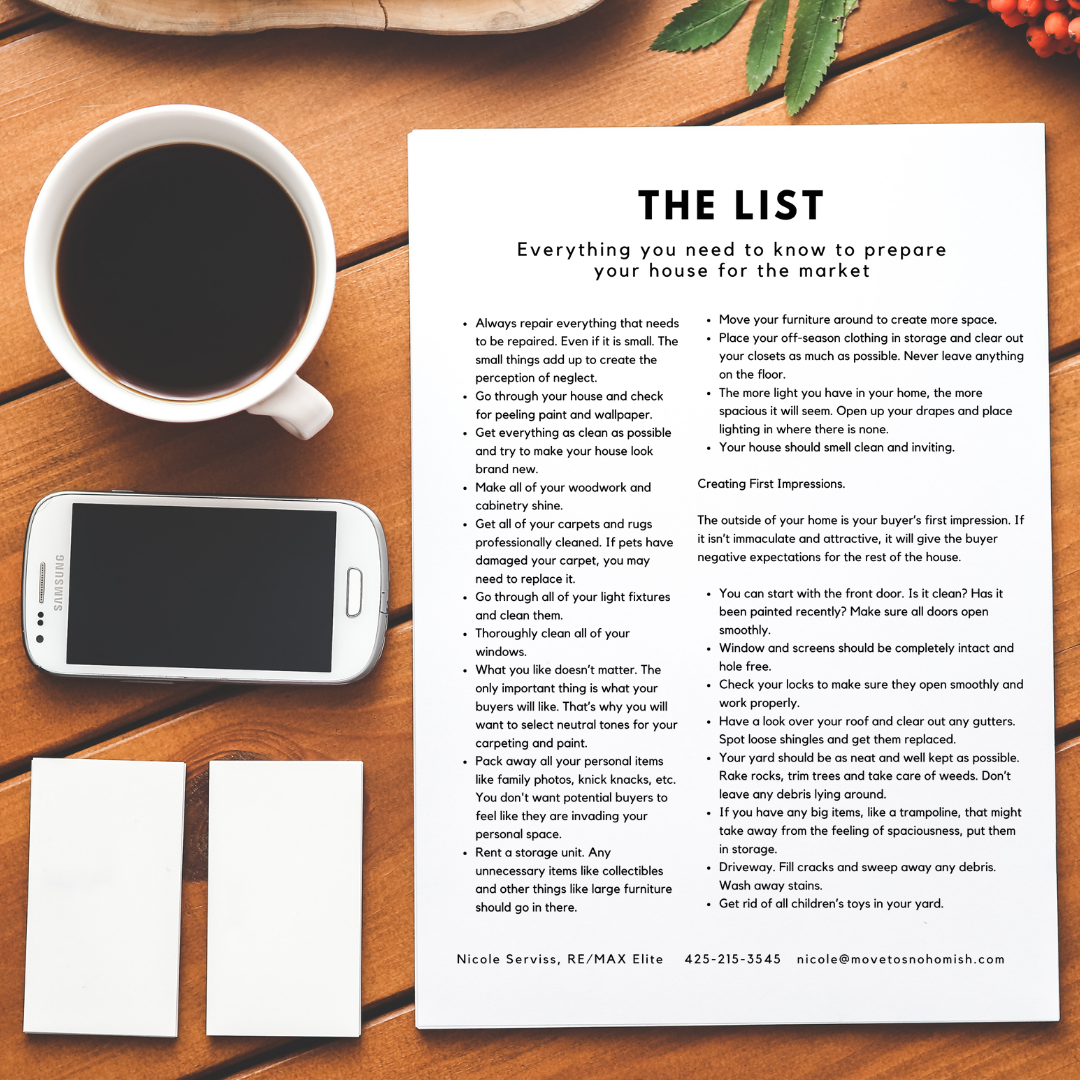

Get My House Ready To Sell - The Ultimate Checklist

Get My House Ready To Sell

Everything you need to know to prepare your house for the market

Nicole Serviss, RE/MAX Elite

It’s a long list but if you do take the time to take care of your home, you will see the results.

Always repair everything that needs to be repaired. Even if it is small. The small things add up to create the perception of neglect.

Go through your house and check for peeling paint and wallpaper.

Get everything as clean as possible and try to make your house look brand new.

Make all of your woodwork and cabinetry shine.

Get all of your carpets and rugs professionally cleaned. If pets have damaged your carpet, you may need to replace it.

Go through all of your light fixtures and clean them.

Thoroughly clean all of your windows.

What you like doesn’t matter. The only important thing is what your buyers will like.

Select neutral tones for your carpeting and paint.

Pack away all your personal items like family photos, knick knacks, etc. You don't want potential buyers to feel like they are invading your personal space.

Rent a storage unit. Any unnecessary items like collectibles and other things like large furniture should go in there.

Move your furniture around to create more space.

Place your off-season clothing in storage and clear out your closets as much as possible. Never leave anything on the floor.

The more light you have in your home, the more spacious it will seem. Open up your drapes and place lighting in where there is none.

Your house should smell clean and inviting.

Creating First Impressions.

The outside of your home is your buyer’s first impression.

If it isn’t immaculate and attractive, it will give the buyer negative expectations for the rest of the house.

You can start with the front door. Is it clean? Has it been painted recently? Make sure all doors open smoothly.

Window and screens should be completely intact and hole free.

Check your locks to make sure they open smoothly and work properly.

Have a look over your roof and clear out any gutters. Spot loose shingles and get them replaced.

Your yard should be as neat and well kept as possible.

Rake rocks, trim trees and take care of weeds. Don’t leave any debris lying around.

If you have any big items, like a trampoline, that might take away from the feeling of spaciousness, put them in storage.

Driveway. Fill cracks and sweep away any debris. Wash away stains.

Get rid of all children’s toys in your yard.

Let's head inside.

If you have a closet in your entryway, make sure it is extra roomy. Remove any out of season clothing and put it in storage.

Decorate your mantle with something colorful, attractive, and simple. Less is more here.

Get rid of extra furniture and create more space. If a piece of furniture impedes your motion through or a room or makes it feel cramped, you need to put it in storage.

Make sure there are no burnt out bulbs!

Clear out your fireplace. Keep it neat and well swept.

Dining table. If you use extra chairs for your guests, put them in storage. If your table has extra leaves, remove them.

Clear the counters.

If your prospective buyers see a lot of unnecessary kitchen tools, they might get the idea that your kitchen isn’t spacious enough. Put everything you don’t use all the time into storage.

Everything should be immaculate and shiny. This is especially important for appliances.

Clear any clutter from the top of your refrigerator.

Hide your trashcan under your sink or put it in the garage during showings.

Keep all of your storage areas organized.

Make sure your washer and dryer are absolutely spotless and sparkling clean.

Laundry Room. Clear away any unnecessary items and dirty clothes.

Double check your stairway railings to be extra certain they are tight and secure.

Change the sheets on your bed to the nicest ones you can find.

Get your kids to go through all of their things and throw away old toys they don’t use.

Every closet should be properly lit.

Open up your closets by getting rid of extra clothing.

Put every questionable wall hanging or poster into storage until your house is sold. Anything too strange will distract your buyers.

Bathrooms must be extra clean and have no questionable smells.

Replace all of your worn out shower curtains.

Repair bathtub and shower caulking.

Repair leaky faucets and clear away any calcium, lime, or rust deposits wherever you see them.

Put away your personal products after every use.

Organize all of your cabinets and storage areas. Remove old products that you don’t use anymore.

Increase the space in your garage by organizing everything. Remove unnecessary tools or toys, and put them into storage.

Remove all cars from the garage before each showing. A garage without cars always looks bigger.

Make sure you garage door opener works and that the garage door closes properly. If not, hire a professional to repair it.

It’s all work that is worth it!

Reach out with questions!

You might be interested in…

What to Check For on a Final Walkthrough

When you purchase a home, you have the option to walk through it one more time right before it becomes officially yours. Here are some things to look out for so that you make sure you are getting the house in the condition you expected.

What to Check For on a Final Walkthrough

Nicole Serviss, RE/MAX Elite

First of all, what is a final walkthrough? When you purchase a home, you have the option to walk through it one more time right before it becomes officially yours. You get to check on the items the seller promised to fix in the home inspection and make sure the home is in the same condition you first saw it in.

There is a lot to look for so I put together a handy list to use when you do. Here are some things to look out for so that you make sure you are getting the house in the condition you expected.

If you have any questions, don’t hesitate to reach out here.

The List

Printable Version (click here)

Test all the lights.

Flip every light switch on and off to make sure there are no electrical issues.

Check the garage.

Test the doors. Make sure the safety auto reverse feature works.

Test the heating and air.

This is a costly replacement if functionality is lacking.

Test out the garbage disposal and all exhaust fans.

Check the fans on the stove and in the bathrooms/laundry room.

Look closely at the appliances.

Make sure the oven and stove work and double check the ice maker on the fridge is functioning.

Open and close windows.

Make sure they open and close properly and that locks are working.

Take note of cleanliness.

Check for trash or debris left behind and if carpets have been professionally cleaned.

Inspect walls, ceilings, and floors.

Make sure no holes have been made in the walls with the move.

Test all outlets.

Check the circuit breaker if there are any issues.

Check the plumbing.

Run all sinks, showers, and bathtubs. Flush all the toilets. Check for leaks.

Check the pipes.

Look for leaks or cracks around all visible piping.

Check the doors.

Pay attention to all knobs and locks. Also, check the doorbell.

16 Questions to Ask a Lender

Loan terms, rates and products can vary significantly from one lending company to the next. Plus, how do you handle closings in the age of COVID-19?

16 Questions to Ask a Lender

Nicole Serviss, RE/MAX Elite

If you have any questions, don’t hesitate to reach out here.

What are the most popular mortgages you offer? Why are they so popular?

Are your rates, terms, fees and closing costs negotiable?

Do you offer discounts for inspections, homeownership classes or automatic payment set-up?

Will I have to buy private mortgage insurance? If so, how much will it cost and how long will it be required?

What escrow requirements do you have?

What kind of bill-pay options do you offer?

Do you do remote closings?

Explain the process of closing with social distancing.

What would be included in my mortgage payment (homeowners insurance, property taxes, etc.)?

Which type of mortgage plan would you recommend for my situation?

Who will service this loan? Your bank or another company?

How long will the rate on this loan be locked-in? Will I be able to obtain a lower rate if the market rate drops during the lock-in period?

How long will the loan approval process take?

How long will it take to close the loan?

Are there any charges or penalties for prepaying this loan?

How much will I be paying in total over the life of this loan?

You might be interested in…

85 Things Not To Neglect When Selling Your House FSBO (For Sale By Owner)

The best way to sell your house is to sell it fast. When your house isn’t in the best condition, the appearance isn't great or if it isn't priced right, it sits on the market for far too long and becomes stale. That’s when people begin to wonder what’s wrong with it...

85 Things Not to Neglect When Selling Your House

Nicole Serviss, RE/MAX Elite

When you put your home on the market, it needs to be immaculate. It needs to have all of the positive aspects that attract buyers. These days, it simply isn’t enough to just take care of basic repairs and cleaning. Your home needs to be presented in a light that gets buyers to imagine all the possibilities. You need to make them dream.

Take care of every little repair and do whatever is in your power to make your home desirable on the first day you show it, not the last. Your home must be clean, neutral, and spacious.

Every room needs to be “staged,” with lighting and arrangements that show off its features. If you miss any of these steps, you risk losing that potential buyer. And once you lose that chance at a great first impression, you might lose any chance of selling it for a decent price.

It’s a long list but if you do take the time to take care of your home, you will see the results.

This list works great for those of you thinking of selling your home FSBO (For Sale By Owner). If you have any questions, don’t hesitate to reach out here.

You might be interested in…

Interviewing A Management Company

If you decide to hire a property manager, it's a good idea to visit the management company's office and interview the prospective property manager.

Interviewing A Management Company

Nicole Serviss, RE/MAX Elite

If you decide to hire a property manager, it's a good idea to visit the management company's office and interview the prospective property manager.

Questions to ask include:

How many years of experience do you have?

What management services do you provide? Can I have that in writing?

How do you structure your fees?

Are there fees when the property is vacant?

How do you screen tenants?

What kind of insurance coverage do you have?

Are employees bonded?

How are funds for different properties handled?

Is there a single account for all properties or an individual account for each?

How do you stay current on local, state, and federal laws?

How often do you communicate with clients and how do you present reports?

How quickly do you get properties on the market?

What are your average vacancy rates?

You might be interested in…

Types of Property Ownership

Learn that pros and cons of the different types of property ownership.

Types of Property Ownership

Nicole Serviss, RE/MAX Elite

Sole Proprietorship

A sole proprietorship is a business owned and run by an individual or spouses. The owners receive the net income as ordinary income, which is taxed at the owner’s personal rate. Simplicity is its main advantage as organizing as a sole proprietorship requires no legal setup, no extra tax reporting, and no additional partners. Its main disadvantage is unlimited liability. Sole proprietorships do not provide any asset protection. In the case of a lawsuit, all of the owner’s personal assets are all at risk.

General Partnership

A general partnership is similar to a sole proprietorship in that each of the individual owners is liable for income taxes on his or her share of the business income. Partners are also personally liable for the actions and debts of the partnership. The partnership terminates upon the death, disability, or withdrawal of any one partner. However, most partnership agreements anticipate these types of events; by prior agreement, the remaining partners purchase the departing partner’s share.

Limited Partnership

A limited partnership is structured around a general partner and limited partners, who invest in the enterprise. The general partner has management control and is responsible for all business actions and debts. The limited partners, who contribute capital and have little involvement in day-to-day operations, are not liable for any debts. The advantage for the general partner is access to a pool of capital. The limited partners receive a stream of profits and losses without any of the work of property management.

Limited Liability Company (LLC)

Limited liability companies have the advantage of providing asset protection but at the same time avoiding the double taxation that comes with a C corporation. LLCs also limit the owner’s liability to the extent of their investments. They are also easier to set up than corporations, and do not require shareholders or annual meetings. LLCs can have multiple owners (called members), and the members can be individuals or partnerships, trusts, foreign investors, or corporations, each owning different percentages. Most states permit single-member LLCs (although there may be tax consequences for these), but spouses are considered two members when forming an LLC.

The LLC is a pass-through entity that helps the owners avoid paying both corporate and personal taxes. The owner of a one-member LLC does not need to file a separate tax return for the business entity. All of the income and expenses, which are deductible, are reported on the LLC operator’s tax return. On the downside, the single-owner is required to pay self-employment tax on income generated. The challenge for single- owner LLCs is to keep a strict separation between the business entity and the owner’s personal and other business affairs.

S Corporation

The S corporation is a pass-through entity that offers the benefit of limiting the liability of the owners. Owners pay personal income tax on corporate profits, while the corporation reports those taxes under its own corporate tax returns. Owners pay taxes on their salaries, bonuses, and dividends as well as retained earnings. As a separate structure, S corporations require scheduled director and shareholder meetings, minutes from those meetings, adoption and updates to by-laws, stock transfers, and records maintenance.

S corporation owners are compensated by paying themselves a salary. Excess profits can be distributed as dividends. The S corporation, however, has limited utility as an ownership entity for investment real estate because no more than 25 percent of gross receipts can come from passive activity.

C Corporation

The C Corporation is an independent legal entity owned by the shareholders and is treated as a separate entity for tax purposes. It is separate from those who own, control, and manage it, therefore the corporation itself, not the shareholders that own it, is held legally liable for the actions and debts the business incurs.

The C Corporation pays corporate tax, and the owners pay personal income tax only on their salaries, bonuses, and dividends. The C Corporation not only has the disadvantage of double taxation, it is also more costly and time-consuming to set-up and operate, and requires additional record keeping.

Have questions about the investment process?

You might be interested in…

Questions To Ask Yourself Before Investing In Real Estate

Make sure your goal is specific, includes measurable numbers, has a timeframe for accomplishment, and is relevant to your lifestyle and the property you ultimately choose.

Questions to Ask Yourself Before Investing in Real Estate

Nicole Serviss, RE/MAX Elite

Short but sweet list of questions you should ask yourself before you invest in real estate. I have an easy printable version. Just click the button to download.

What type of property are you interested in (single family or multi-family)?

There are pros and cons to owning a single family home, a condo, or a multifamily unit for the purposes of investment. You’ll want to decide upfront what you are looking for.

What area are you interested in?

This question is important to answer when you are thinking of the type of tenant you want as well as the decision to self manage the investment or to hire a property manager. You probably want the property to be local if you plan on self managing.

Is there a particular type of tenant or renter you want to attract?

Are you in a military area? College town? Vacation town? Decide what type of tenant you want to attract so your agent can help you find the right property for that type of tenant.

Is this your first real estate purchase?

Real estate is very unique, and the investment process is a little more complex than if you were to be buying for yourself.

What prompted you to invest now?

Is the reason a good one to jump on this right away or would it be better to wait?

Will there be others involved in the investment?

This is important to talk through with your CPA, Realtor, and Lender so you know what type of ownership you will be taking with the property.

Are you looking for a profit in the future or additional income in the present?

The will help you determine what kind of return on your investment you are looking for. Ask yourself how long you plan on holding onto your investment too. This will help you determine the type of profit you are looking for.

What is the source of your current income? What assets do you have?

How secure is your financial situation? If your investment were to remain vacant for a few months, would you be okay?

How do you plan to fund the investment?

Will you be borrowing the money from a bank or paying cash? How much do you have for a down payment. Typically you need a minimum of 25% down for an investment.

Do you have a business or financial plan?

How does this plan to purchase an investment property fit with your plans?

What is your current tax liability?

Chat through this one with your CPA.

Will you self-manage the property or hire a management company?

This will help you determine where to search for your investment. Sometimes it’s just easier to pay someone else to manage it, but that can also eat at your profits. Decide what is most important.

“Make sure your goal is specific, includes measurable numbers, has a timeframe for accomplishment, and is relevant to your lifestyle and the property you ultimately choose.”

Fill in the blanks.

My goal is to _______________________________________(priority)

by investing in a _____________________________(type of property)

that will yield _______________________________________(% or $).

Have questions about the investment process?

You might be interested in…

July 2020 Market Update - Snohomish County Real Estate

Your Snohomish County real estate market update for July, 2020.

*Week of 7/23/2020, Source http://www.freddiemac.com/pmms/

Let’s start by taking a look at the interest rates. They are at historic lows. I really hate using the word “historic” because it sounds like I’m trying to sell you something, but these rates really are historically low. It’s incredibly cheap to borrow money right now.

If you’re a home seller—This means you have a lot of buyers that can leverage more buying power because their monthly payments are much lower at this rate than the rates last year.

If you’re a potential buyer—You can use this time to borrow money and even though home prices have risen, your monthly payment might not because of these low rates.

*Stats for June 2020, Source NWMLS.com

Now onto the real estate stats.

We have 9% less listings coming on the market.

We have an increase of 21.5% in pending home sales.

Homes are only on the market an average of 20 days before they find a buyer.

Your average sales price has increase over 5% to a range of $539k to $581k.

When a house does sell, it is selling for an average of 101% of the listed price.

What this translate to is a strong seller’s market. This is for all of Snohomish County, which is a huge county. Each city and area is unique, but overall, our real estate market is strong and healthy.

FAQS

Why have prices increased?

When you have a low number of homes for sale and a high demand for homes from buyers, you get buyers competing with each other to win. One of the best ways to do that is to offer to pay more money. Every time this happens, this helps the next future house sell for more as well because the overall value of the area increases.

Is it a good time to sell?

Yes! A lot of homes that are marketed well and priced at fair market value are selling for at or above their listed price and in record times.

Is it a good time to buy?

While it is difficult at times to compete with all the other buyers out there, it is still a great time to buy because money is so cheap to borrow right now. The prices of homes are projected to continue to increase, so it will only get more and more expensive.

Have a question you want answered?

Contact Nicole here.

A One Week Snapshot of the Market

🏠 In the last 7 days, we have had 321 new listings hit the market. Still not enough homes for sale though. Look at how many have found buyers and have sold!

🏠 586 homes found buyers!

🏠 352 homes sold!

We consistently have around 250-275 homes listed each week and the number of homes sold keeps increasing. This is such a strong seller’s market.

We are in an inventory shortage, meaning we need more homes for sale. If you’ve been thinking of selling your house, now is a great time. Interest rates are low and we have a large pool of buyers ready to buy. Please reach out if I can help answer any questions.

📈 Want more stats specific to you and your niche market? Contact me here.

Last Week’s Stats

You might be interested in…

Market Update - Snohomish County Real Estate 4/10/2020

Your Snohomish County real estate market update for April 10th, 2020.

Snohomish County Real Estate Market

April 10th, 2020

Nicole Serviss, RE/MAX Elite

📈 Market update 📈

In Snohomish County, in the last 7 days, we have had a healthy number (207) of new listings hit the market.

🏠 23 homes increased their asking price while 93 decreased their asking price.

🏠 260 homes found buyers! That is great considering the economic unrest right now.

🏠 57 homes lost buyers and are back on the market. This happens for various reasons, but I wouldn't be surprised if it was because of job uncertainty for home buyers. This number is smaller than last week. I was expecting to see more cancelled listings, but only 15 listings decided to go off the market this week.

📈 Want more stats specific to you and your niche market? Contact me here.

Median Sales Price

$500,000

Days on Market

11

You might be interested in…

5 Myths About Buying a House

1. You need a 20% down payment. False. While it's best practice to put 20% down, you can find loans that offer great terms as low as 0% down…

5 Myths About Buying a House

Nicole Serviss, RE/MAX Elite

The 5 most common myths, busted!

1. You need a 20% down payment.

False. While it's best practice to put 20% down to avoid paying mortgage insurance, you can find loans that offer great terms as low as 0% down.

2. You need to pay your Realtor.

False. The seller pays for the real estate commission.

3. Your credit score needs to be perfect.

False. You only need a 620+ to qualify. Different loans and programs have different requirements, but if you’re close to that score, it’s worth it to talk to a lender and find out if you can be approved for a mortgage.

4. You should wait to apply for a loan until you've found your dream house.

False. You’ll want to get pre-approved (and that’s different than pre-qualified) before you start the home shopping process. Why? Because when you submit an offer on a house, you include your pre-approval letter with your offer to prove to the sellers that you can afford this house. You don’t want to miss out on your dream home while you’re waiting for your lender to approve you.

5. My 100% Perfect house exists.

False. Even people that custom build their home always have something they'd change about it. When you walk through a house, rate it from 1 to 10. 10 being your dream house. If you rate it around an 8.5-9.5, that's a house you consider writing an offer on. Ask yourself what this house needs to be a 10. Then make sure those are things you're willing to compromise on. If not, are they things you can afford to fix.

I hope you found this information helpful. If you did, or if you have any questions, please let me know.

Professional staging in Snohomish helps your home sell faster and for more. Learn why Nicole Serviss includes it in her listings, and how it boosts results.