LEARN MORE ABOUT THE LOCAL MARKET.

How to Avoid Wire Fraud in a Real Estate Transaction

Wire fraud is a very real risk. Scammers have gotten very good and duplicating emails that look like they’re coming from your Realtor, Lender, or Escrow Officer.

How to Avoid Wire Fraud in a Real Estate Transaction

Nicole Serviss, RE/MAX Elite

Wire fraud is a very real risk. Scammers have gotten very good and duplicating emails that look like they’re coming from your Realtor, Lender, or Escrow Officer. See below for an example of this:

These scammers were clever. They used an email address almost identical to the broker's email address and they established a sense of urgency, capitalizing on the buyer's fear of economic turmoil due to the Coronavirus. Recently, a couple in San Diego lost almost $800,000 to a wire fraud scam. See article here.

The most common times a scammer will try to get your money is when you need to submit your earnest money payment or when you are paying your closing costs/downpayment on your new home.

Whether you’re in a real estate transaction or not, if you receive an email asking you to wire money, stop and call that person from the phone number you have for them or a number you find online. Verify that is was indeed them and not a scammer.

Stay safe out there and feel free to reach out if you have any questions!

You might be interested in…

Tips For Sellers

If selling your home is on the horizon, read this first.

Quick Tips For Sellers

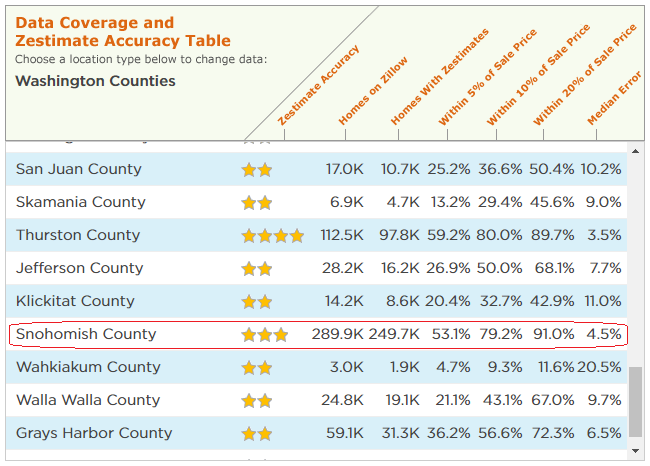

Do NOT rely on Zillow for your home’s value

the fine print tells you they have a median error of 4.5% in Snohomish county. on a $550,000 home, That’s an error of almost $25,000!

If you want a free market analysis of your home to find out your homes true value, l’d be happy to help.

Insist on professional photography - even as an amateur photographer myself, I still always hire a pro.

Price your home at fair market value.

Maybe this seems like a silly tip, but often times sellers are in a tight spot and they need the home to sell for more than it’s worth.

Unfortunately, when you try to list a home overpriced, it won’t sell. Buyer’s will not pay more for a home than they need to.

This ends up costing sellers even more money. Every month that home sits on the market, that another month’s mortgage they’re paying.

Try to see the home through your buyer’s eyes. Pack away any personal belongings and decor. Give potential buyers a chance to see themselves living there.

I love all your family photos. I have similar photos all over my walls. I have kids’ art. I have special trinkets displayed. But those things are only special to me and my family.

When a potential buyer walks through your property, you don’t want them to see how you live there. You want them to envision themselves living there. That’s the whole reason they’re there.

Think of it as pre-packing for your move. De-personalize your home as much as you can. Remember, it’s only for a short time.

Are you thinking of listing your home?

Shoot me an email, send me a text, call me, fax me, send a message in a bottle (it might take a while, but I’ll respond) and let’s see if I’m that perfect fit for you.

You might be interested in…

Tips For Buyers

Quick Tips For First or Second Time Home Buyers

Quick Tips For Home Buyers

Get pre-approved before you start looking for homes.

Getting set up with a lender before you start looking for a home is a must. Can you begin your house hunt before? Well, yes, you can do what you want.

However, It can be super disappointing if you don’t get approved for the price of home you thought you could get.

This is a crucial step 1 in the home buying process. If you need a recommendation on a lender, let me know. I’ll get you connected.

Always hire a professional home inspector to do your inspection.

“But, I have a good friend who’s a contractor and he said he’d look over the house for free.” No. Don’t do it.

Will he find everything wrong with the house? Maybe. Can we use that information to open up negotiations again and ask the sellers to do the work on the house? Maybe.

Do you really want to risk one of the biggest purchased of your life on a maybe? Spend the $500 give or take on a good home inspection. It’ll give us negotiating power and it’ll give you a full picture of the home so you can decide with certainty if this is still the home for you.

Choose a full time real estate agent.

You want to make sure that when a listing you want to see comes on the market, your realtor is 100% available to show you.

Know the costs before you get under contract.

Buying a home can be expensive, and I’m not just talking about the price tag on the home. There’s the closing costs, inspection costs, escrow fees, etc.

Find out more about who pays for what in my blog here.

Do not call the name on the sign for more info. Call your Realtor®.

Will the listing agent flat out lie about the home? I’d sure hope not.

But will they tell you the information you want to hear through rose colored glasses? You betcha! They represent the seller, not you. They are looking out for their client’s best interest, not yours.

When you have a question about a property, call YOUR agent and let them filter out the sparkle.

Find a Realtor® who works well with your communication style.

Do you like to text? Are you more of an email kind of person? Do you like to communicate through messenger pigeon?

You want to find an agent who will communicate with you in the way that works best with your style, job, and schedule.

The seller will pay for your Realtor®, so hire EXACTLY who you want.

This is HUGE! You as a buyer don’t pay any commission fees.

The seller pays for that. A good Realtor® makes the same amount of money on the transaction as a bad one. Hire the one YOU want.

So, about hiring the best realtor for you… I know a Realtor®. That person is me.

Shoot me an email, send me a text, call me, fax me, send a message in a bottle (it might take a while, but I’ll respond) and let’s see if I’m that perfect fit for you.

You might be interested in…

Outdated Advice Buyers Should Ignore

There are SO many places to get advice about real estate transactions, but not all are created equal and not all advice is good.

Do you ever read those articles about what buyers should and shouldn’t do and you think to yourself… well ya, duh! I’m not an idiot.

There are SO many places to get advice about real estate transactions, but not all are created equal and not all advice is good.

We don’t live in the times of classified ads anymore. No one finds a home in their local newspaper or magazine. We have the glorious internet, an endless source of information. You buyers are educated. You buyers know what you want.

Realtor.com® recently highlighted some of the most common advice home buyers hear that no longer applies in the current housing market, including:

“Wait for spring.”

Advice like this is KEY for sellers when deciding when is the best and most likely time to list their home to have the best advantage, but buyers don’t need to wait for any “good” time to buy. Yes, spring is busy and there’s more inventory on the market, but that also means there’s more buyers out looking too. More buyers = more competition. Plus, sellers feel like since it’s the best time to sell, they are less likely to negotiate on price.

Buy when you find the right property that will meet your needs today, tomorrow, and the next five to ten years.

“Wait for home prices to come down.”

There’s always that fear of buying at the top of the market. It’s not all that irrational. But when you consider the cost of renting (which is also probably at its highest) you’re literally throwing money away. Paying high rent now and hoping that you’ll find a better deal two or three years down the road won’t work.

The better advice is to make a smart buy today for a property that will appreciate over the longer term.

“Make a lower offer so you have room to negotiate.”

Some buyers may be told to make an offer that’s less than what they’re actually willing to pay for a home. “Give yourself room to negotiate.” They say.

The old adage to offer 10 to 15% below asking is not necessarily the case anymore. (This advice does not apply to overpriced homes. That’s a whole other blog post for another day.) Sellers are competing against other homes in their area and most likely have already priced their home competitively.

The better advice is to base your offer on sales of similar homes in the area.

You might be interested in…

FAQS

Your most common questions about real estate answered.

WHAT IS ESCROW?

Escrow can mean 2 things. 1. The period of time between mutual acceptance and closing day. 2. The neutral 3rd party that handles documents and facilitates closing paperwork.

HOW LONG WILL IT TAKE?

Most escrows are around 30-45 days. Cash deals can decrease the escrow time, as securing the lending takes the majority of the time. You can decrease that time by being not only pre-approved, but pre-underwritten before you even make an offer.

WHAT SHOULD MY DOWN PAYMENT BE?

It depends on your loan, but typically they are between 3 and 5% of the purchase price. There are lots of down-payment assistance programs to help with this!

WHAT IS EARNEST MONEY?

It is a good-faith deposit you make to the seller. It can range from $500-$10,000+ depending on the list price of the home. You need to have these funds available when you make an offer on a house.

CAN I GET A BETTER DEAL ON A SHORT SALE?

The easiest way to understand a short sale is the sale of a home in which the proceeds from the sale are less than the balance of debts secured by liens against the property and the home owner cannot afford to pay the liens in full. Despite their name, they take much longer than your average sale.

HOW MUCH DOES IT ALL COST?

As a buyer, hiring a Realtor costs you NOTHING. The seller pays the commissions. A home inspection can cost between $400-600. Closing costs can be around 3% of the purchase price.

WHO PAYS FOR CLOSING COSTS?

It can vary. You can ask the seller to pay for them in full or pay up to a certain amount. We can find out closing costs before making an offer so you have all the information at hand.

DO I REALLY NEED TO DO A FINAL WALK THROUGH?

Legally, no. But you absolutely should. We will do that together to make sure the sellers left the home in good condition. You don't want to open up the door to your new home and see a broken water pipe...

You might be interested in…

Professional staging in Snohomish helps your home sell faster and for more. Learn why Nicole Serviss includes it in her listings, and how it boosts results.